》Click to View SMM Spot Aluminum Quotations

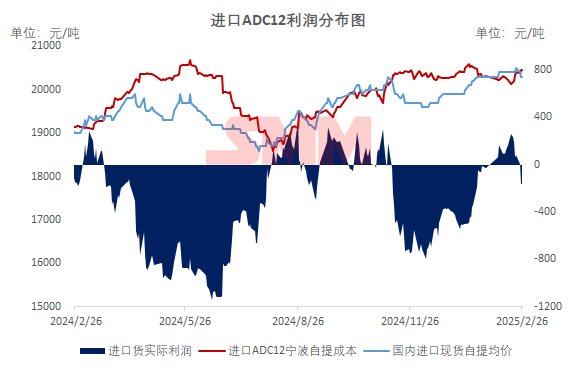

【Aluminum Prices Rebound, Secondary Aluminum Prices Struggle to Catch Up】Today, aluminum prices saw a slight rebound, with SMM A00 aluminum prices rising by 140 yuan/mt from the previous trading day to 20,530 yuan/mt, while secondary aluminum prices remained stable. Domestically, SMM ADC12 prices were unchanged at 21,100-21,300 yuan/mt. In the import market, overseas ADC12 prices remained steady in the range of $2,480-2,500/mt, with ADC12 import real-time profit maintaining a slight loss, keeping the import window closed. Today's aluminum price rebound was met with a generally cautious attitude in the secondary aluminum market, with manufacturers primarily maintaining stable quotations. Currently, manufacturers' operating rates have returned to normal, but downstream demand remains weak, overall transactions are moderate, and social and production site inventories are accumulating, leading to insufficient momentum for price increases. In the short term, ADC12 prices are expected to fluctuate rangebound, with upside room constrained by supply growth pressure and the slow pace of demand recovery, while downside is supported by aluminum scrap costs. Attention should be focused on the recent circulation of raw materials and the recovery of end-use consumption.

Note: Import profit refers to real-time profit